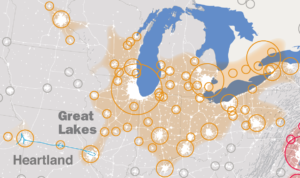

What is BioGenerator? The short answer: A subsidiary of the non-profit organization BioSTL that was formed in 2003 to create, grow and invest in life science startups in the St. Louis region.

The long answer: Their footprint is more complex than what a single sentence can explain.

“Most people probably don’t realize that we actually have a really complex mission,” says Eric Gulve, president of BioGenerator. “We are addressing a number of different issues in the life science startup space. Specifically, over the past six years or so, we’ve developed a suite of programs and activities intended to provide support for life science startups, encompassing a wide range of stages: It can be as early as an initial discussion with someone who has a new discovery or idea, that may or may not have commercial significance, and then progressing all the way to supporting the syndication of a major venture round.”

He continues, “As a 501(c)3, we provide early-stage education, advice, and financial support whereas when it comes to investments we seek to operate as a smart investor. It’s a challenging task in that we support the entire life sciences sector: sectors as diverse as agriculture, therapeutics, medical devices, diagnostics, bioenergy, and healthcare services. Within our investment objectives we have some economic development priorities for the region that typically don’t overlap with desired elements of a traditional venture-based investment. So for example we invest in business models such as contract research organizations that provide expert technical services to the biotech industry; these types of companies can grow jobs at a faster rates than many venture-backed investments. Overall, we’re trying to jumpstart the life science landscape here in St. Louis, so we are challenged to support a very large portfolio with diverse objectives compared to what a very focused for-profit investment firm might support.”

To explain the functions of the firm further, Gulve took some time to talk out the different pieces of the BioGenerator puzzle:

BioGenerator Invests:

BioGenerator started out investing in seed-stage companies with the idea that by providing capital, along with advice from their expert staff, they’d be able to bring companies to the point where they could raise their own venture round.

But when the current team began operating in 2009, it didn’t take them long to recognize more support was needed.

“Today we have four discrete funds that are basically staged in terms of how early or late we feel that company is. Deployment of capital is stage, sector and deal-specific,” he says. “Our earlier-stage funds provide capital to de-risk technical and business concepts and can be deployed more rapidly. For early-stage deals, we can either be the sole source of funds or can syndicate with investors willing to provide initial capital such as our local accelerators and economic development groups. For somewhat more mature opportunities, we often syndicate with angel investors and smaller for-profit investment groups. For the most mature companies in our portfolio, that’s when we’re going out and helping those companies try to raise VC and private equity capital.”

As the BioGenerator portfolio has matured in the last five-six years, the firm has added a new priority: finding larger sums of capital outside of St. Louis. A number of leading portfolio companies have successfully closed major financing rounds: Gulve estimates more than $160 million has been raised by their portfolio companies just in the last two years.

BioGenerator Vets Companies

When considering companies to support, BioGenerator staff note that many first-time founders lack an understanding of how important it is for a life science company to have entrepreneurial talent and experience in order to successfully compete for gain funding.

“There are a lot of great science ideas out there, but in order for something to be an investable startup, it has to be a viable business,” he says. “Investors need to understand how an invention or concept gets to product and revenue, the big dollars needed and the risks – technical, business, financing. Startups need to have people who understand what it takes to get from the start to the finish line, who can formulate the overall strategy, present a compelling vision to investors, and ensure that the company can execute on the tactical details.”

Important factors the BioGenerator investment team considers include: the overall regional impact of the company; the quality of management, key scientists and advisors; the quality of the business from a strategic perspective; and the quality of the business’ R&D plans.

“We also look to see if the opportunity is fundable as a startup company, specifically in the St. Louis region given the funding constraints and talent pool that we have here,” says Gulve. “We see a lot of opportunities that might be very interesting, but if it requires a $10 million investment in the first stage, then it’s going to be very challenging to fund as a startup here.”

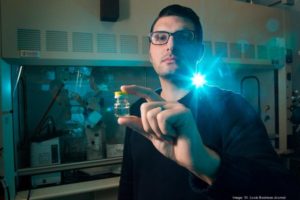

BioGenerator Creates Infrastructure

There is no tip-toeing around it, creating and maintaining a life science company is very expensive, with many of the opportunities in St. Louis requiring pre-clinical research using equipment that can cost anywhere from tens to hundreds of thousands of dollars.

“We started out as seed investors, but the current BioGenerator leadership recognized 5-6 years ago that we couldn’t afford to passively wait for seed-stage deals to come to us, that we had to play a very active role in generating seed-stage deal flow by investing in earlier stage deals. To do that, we had to put less money into riskier, early-stage companies, and we couldn’t do that if we had to pay for the same physical infrastructure again and again.”

So to make their mission affordable, BioGenerator took on the cost of lab space and equipment.

“My colleague Charlie Bolten was instrumental with what we developed,” Gulve says. “He envisioned a model that honestly had never been implemented anywhere in the country to our knowledge: we would pay for those [equipment, lab buildout, and long-term lease] costs and then the lab space and equipment would be shared across a whole range of portfolio companies.”

This idea stands in opposition to the older model, where each company would rent its own lab space and buy its own equipment—some of which you might only use for an hour a day yet still spend thousands on.

“Charlie’s goal is to increase the density and increase the use of that equipment,” says Gulve. “We’ve got over 100 individuals working in our facility. High density, and packing in scientists and executives from different companies enhances collaboration. It brings a real sense of energy. If you think of the energy of a place like T-REX or CIC@CET, what we’ve done here is try to capture that kind of energy, but do it for the life sciences where you also need access to all of that expensive equipment.”

The BioGenerator Labs are located in the Cortex 1 Building, separate from the firm’s office. In true startup fashion, BioGenerator purchased used equipment from auction houses and the labs operate without having a full-time manager. Another way it keeps costs down is by utilizing its clients and their expertise to maintain and service equipment rather than pay for manufacturer’s service contracts. By keeping costs down, BioGenerator can support a large number of companies and innovative ideas, and the BioGenerator team can focus on attracting highly talented individuals and building strong companies. The labs and equipment are also open to companies not in the BioGenerator portfolio, offering scientists a space to test out ideas when applying for grants or funding.

“This really is a ground-breaking model,” says Gulve. “We started with a small facility originally, 5600 feet, and it became so crowded that a couple years ago we expanded it.”

Now the idea has expanded past the city limits. Gulve says they’ve met a group in Boston operating a later-stage version of their model, but instead of providing everything free of charge, the Boston firm charges the companies to share the equipment, which limits use primarily to companies that have already received venture financing. Gulve says that while valuable, the Boston model might miss out on some of the scrappy, early-stage spirit that creates the perfect place for spontaneous collaborations.

“For us, two individuals who are eating lunch together can start talking about new ideas,” he says. “We’ve seen new companies form from two people who weren’t technically working together before.”

BioGenerator Advises & Looks to Grow

With established universities and a deep history of life science corporations, the St. Louis community is fortunate to have academic and industry scientific and business talent on hand to help entrepreneurs, but when it comes to advising and running companies, the region still has limitations, in particular experience in the startup space.

“We tend to have deep scientific and R&D expertise, but the big gap that we have is business acumen in the startup space,” Gulve says. “So we’re seeking out those individuals who have life science business experience, who are in a position to give back to early-stage companies as mentors, advisors, or startup company executives.

We’re also working on some ideas to figure out how to use the talent we have more efficiently. Rather than build out a whole team for each product opportunity in a particular sector, we’re looking at ways to build a team of experts with complementary expertise that can support a whole range of opportunities in a given industry sector. So don’t build five teams to support five products, build one team to support multiple products.”

BioGenerator Pitches in Wherever They Can

BioGenerator staff members look to support entrepreneurs and companies in diverse ways. These include serving on the boards of of many portfolio companies, recruiting talent (employees, advisors, consultants, service providers), serving as deals leads, networking, introductions to investors, providing scientific or business expertise, advice to first-time founders & entrepreneurs, assistance and feedback to regional tech transfer offices, and support for educational and regional entrepreneurial training programs.

“The scope of activities we undertake is incredibly diverse,” notes Gulve. “Every day we face a new set of challenges and opportunities, and the reward in working for an organization like BioGenerator comes from building partnerships and addressing complex situations where the end goal is to help members of the St. Louis startup community build strong companies that can provide solutions to important societal issues such as healthcare, nutrition, the global food supply, and environmental sustainability.”