Presented by for Trackbill

Economic Complexity Data for St. Louis

This article concludes our 3-part series about economic complexity.

Writing by Mike Fabrizi. Mike Fabrizi was born and raised in St. Louis, Missouri. An expat for 30 years to the Washington, DC area, he recently retired from a career including long stints with The MITRE Corporation, of McLean, Virginia, and The Aerospace Corporation, of El Segundo, California. Mike’s professional interests include complexity and complex adaptive systems, economic complexity, cities, and regenerative agriculture. He looks for ways to bridge the urban-rural divide, and likes to emphasize that which we share in common, not that which divides us. *Most* people everywhere are good. Give them half a chance and the goodness manifests itself. Mike now happily resides back home in St. Louis.

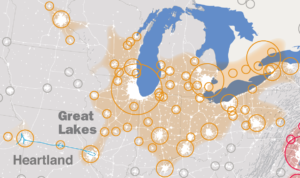

In my previous articles on the Bioscience Labor Market Analysis in St. Louis, I argued that a hollowing out of the Great Lakes megaregion was caused by an overspecialization in the regional economy and explained why embracing economic complexity is more likely to lead to a increasing incomes and affluence in St. Louis.

Let us now turn to the economic complexity data to verify the supposition, raised a few articles ago, that a displacement of product creation and innovation with routinized production will likely result in reduction in economic complexity; the need to bring new information to bear and collaborate with highly skilled people, such as scientists and engineers, will have been pushed aside by standard processes and procedures. Thus, there will have been a “crowding out” of the ability to create new ideas, products, and services due to the demands to produce the “tried and true”.

First, however, let’s take a glimpse at the economic complexity data for various product categories surfaced in the Bioscience Labor Market Analysis and compare them to that for the overall St.Louis Metropolitan Region.

Economic Complexity Rank of St. Louis

The overall economic complexity for the St. Louis Metropolitan Area is 0.81 (as of 2023), which ranks the area as 1st out of 40 similar, mid-sized metropolitan areas. Table 1, below (taken from the Observatory of Economic Complexity (OEC) website with values last updated in 2022, the most recent year for which full-year data is available), provides the product complexity indices (PCIs) for the output of various mid-level skillsets detailed in the Labor Market Analysis.

| Product | PCI Value | Rank |

|---|---|---|

| Pesticides | 0.045 | 539/1033 |

| Pharmaceuticals | 1.28 | 9/96 |

| Chemical Products | 0.29 | 9/21 |

| Fertilizers (all) | -1.30 | 90/96 |

| Medical, Surgical, or Laboratory Sterilizers | 0.56 | 1536/4653 |

| Medical Instruments | 0.89 | 211/1033 |

| Instruments, Appliances for Medical, etc. Science | 0.51 | 1616/4653 |

3 Observations About Product Complexity in St. Louis

First, the data include both low- and high-skill labor groups within the product categories. For example, for the “Medical Instruments” category, a variety of skillsets, including both relatively low-skilled assemblers and packers as well as high-skilled scientists and engineers, are probably included. Product complexity is thus an imperfect and indirect way of assessing skillsets; its primary focus is that of products.

Second, of the product categories, only pharmaceuticals and medical instruments have PCI values that exceed that of the St. Louis metropolitan area. Some, such as pesticides, chemical products, and fertilizers have index values that are considerably less than the region’s. This suggests that a specialization in these areas, especially one with a focus on lower-skilled production and logistics type work, could result in lowering the region’s complexity and, hence, might bode ill for continuing the path to prosperity of rising incomes and affluence.

Third, there is no reason to suppose that the PCI values are constants. Quite to the contrary, altering the skill mix associated with the product categories will likely alter the index values. This is an important point that bears reflection. As noted elsewhere in this article, as products or services become standardized, the skill mixes required for their production will change, altering (and probably lowering) the values of their PCIs.

Back to the Central Argument – Routinizing Production Reduces Economic Complexity

To reiterate the above paragraphs, we would expect a larger PCI for a product the manufacture of which:

- Requires sophisticated information normally possessed by highly skilled and educated people,

- Knowhow, in that these professionals need to know how to work together as well as with production and operations staff,

- Further knowhow, in that firms and other ecosystems actors need to learn to collaborate with each other and achieve coherence of efforts.

By contrast, we would expect the manufacture of relatively simple products the production of which has been largely systematized and dependent primarily on executing well-defined processes (which do not require sophisticated skills) to have lower PCI values.

For example, spacecraft manufacture often requires sophisticated skills, exotic materials, and state-of-the-part production techniques. While the world is moving towards a commoditization of space, there are still specialized craft, with unique missions that require them to operate in hostile environments such as the far reaches of the solar system, that are “one of a kind”.

By contrast, the manufacture of shirts has been systematized; these are produced throughout the world and in regions that cannot presently produce more sophisticated goods. Turning again to the OEC website (2022 data), we find a value of 1.22 for spacecraft (474th out of 4653 comparable products), whilst the value for shirts is -1.21 (895th out of 1033 products).

Table 2, below, presents the PCI values for various “high end” products, the manufacture of which requires considerable information and knowhow that are not ubiquitous, for comparison against the shirt PCI.

| Product | PCI Value | Rank |

|---|---|---|

| Spacecraft | 1.22 | 474/4653 |

| MRI Machines | 1.51 | 186/4776 |

| Lithium Batteries | 1.19 | 520/4776 |

| Electric Resistance Furnaces for Semiconductor Manufacturing | 1.67 | 76/5606 |

This single example does not, of course, prove the point that systematization always leads to diminution of economic fortunes. It does suggest, however, how a “hollowing out” of a region’s prosperity engine could occur.

It also needs to be stressed that none of the above argues for artificially maintaining a high-skill mix after production products have indeed been systematized. Doing so carries with it a high cost burden, and would lead to erosion of market share to regions having lower factor costs. This means, for example, that requiring college degrees for work that genuinely does not require them is a negative.

Instead, the message is that the area’s job mixture needs to be dynamic and self-renewing.

So, What Does All This Mean? –

We Need to Continue Reinventing the St. Louis Economy

Maintaining favorable PCIs and regional affluence requires a continual reinvention of our local economy.

As high-PCI products undergo process systematization, new (but related) products need to supplant them that can ensure the generous compensation associated with sophisticated, rare information and knowhow. One path for such a renewal that builds on the economic complexity literature is movement into adjacent spaces.

In a nutshell, this starts with the skillsets, expertise, and collaborative coalitions already present for existing products. These are then combined with some new expertise as well as some new networking and collaboration to produce newer products the production of which has not yet been reduced to well-defined business and production processes.

For example, the plethora of data being produced by the region’s AgTech and bioscience enterprises might be an enabler for a movement into big data and some components the AI technology stack. This new area would will also offer generous compensation to the skilled, and allow our region’s prosperity to continue and even accelerate.

Conclusions and Recommendations

Per the Bioscience Labor Market Analysis, the St. Louis Metropolitan Area has an enviable position in the AgTech and plant sciences, life science, bioscience, and related fields. The associated jobs offer salaries well above median regional pay, and provide career growth opportunities both for college-educated workers as well as high-school graduates with requisite technical training and on-the-job experience.

A concern addressed in this paper is that these fields, or fields occupying adjacent spaces, continue to offer area workers with prosperous career choices. The salaries offered in the marketplace could be eroded, for example, should the skill mix migrate toward lower-end, commodity-type skills.

This negative outcome would be expected should the skill sets be commoditized and success hinge primarily upon executing well-defined business and production processes without the need to innovate new products in concert with professionals across the region and the world. Simply put, the need to execute and get things done could crowd out new ideas.

Assuring that this downward migration does not happen will require a coherent effort involving the area’s research universities and venture capital community, so that research leading to ideation receives needed funding. It will also require the continued vibrance of technical and vocational training, as typified by the area’s community colleges, to assure a steady stream of qualified technical workers for the new industries.

Finally, it will require great civic and cultural institutions, so that the researchers, entrepreneurs, and technical workers regard the St. Louis Metropolitan Area as a desirable place to live, work, and start businesses.

The key here is coherence. St. Louis needs a vibrant tech and cultural community that works and recreates together so that ideas can be freely exchanged and opportunities created and funded.

In this, technical publications such as EQ certainly have a role to play as do forums, colloquiums, etc. A vibrant “sidewalk culture”, with coffee houses, restaurants, retail, and other venues has traditionally provided meeting places for random encounters for these types of idea exchanges. We need all of this and more!