Presented by for Trackbill

BioSTL’s Bioscience Labor Market Analysis: some Good News and Good Insights

Please join EQ in welcoming our new columnist, Mike Frabrizi, who will be writing about economic complexity and the places we live. His first series of articles reviews the well-articulated and researched paper St. Louis Bioscience Labor Market Analysis (University of Missouri Exceed Extension, December 2021), and extends the good news story and suggest some means by which the former study can be built upon to help ensure that the St. Louis region continues to generate well-paying jobs and that per capita income growth continues.

This week's series of articles builds extensively on economic complexity literature, that includes important publications such as The Atlas of Economic Complexity (Hausmann, Ricardo; Cesar A. Hidalgo, et al, 2013), Why Information Grows: The Evolution of Order, from Atoms to Economies (Hidalgo, Cesar and Allen Lane, 2015), The Building Blocks of Economic Complexity (Hidalgo, Cesar and Ricardo Haussmann, 2009), How and Why Should We Study Economic Complexity (Esteban Ortiz-Ospina and Diana Beltekian, 2018), The Observatory of Economic Complexity, Economic Complexity Theory and Applications (Hidalgo, Cesar, 2021, Nature).

Writing by Mike Fabrizi. Mike Fabrizi was born and raised in St. Louis, Missouri. An expat for 30 years to the Washington, DC area, he recently retired from a career including long stints with The MITRE Corporation, of McLean, Virginia, and The Aerospace Corporation, of El Segundo, California. Mike’s professional interests include complexity and complex adaptive systems, economic complexity, cities, and regenerative agriculture. He looks for ways to bridge the urban-rural divide, and likes to emphasize that which we share in common, not that which divides us. *Most* people everywhere are good. Give them half a chance and the goodness manifests itself. Mike now happily resides back home in St. Louis.

The Bioscience Labor Market Analysis is an excellent piece of analysis, and will doubtlessly provide leaders, policy makers, and other parties interested in the region’s economic health with valuable and actionable insights. The paper provides a wealth of data regarding the regional bioscience labor market.

Quick Summary

Some important findings from the Labor Market Analysis include:

- The average annual earnings of bioscience workers in the St. Louis region is over $116,000. This is well in excess of the regional median pay ($68,964 for St. Louis County and $45,773 for St. Louis City, respectively).

- Bioscience jobs tend to require more training and education than do jobs in other fields, with eight out of ten job openings requiring education or job experience beyond a high school diploma. In fact, 36 percent of bioscience jobs require at least a four-year college degree.

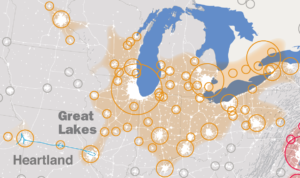

- The relative concentration of manufacturing and production makes the St. Louis region unique. In particular, drugs and pharmaceuticals manufacturing, analytical laboratory instrument manufacturing, dental equipment and supplies manufacturing, and pesticide and other agricultural chemical manufacturing are over represented in the regional economy.

The report segments this market five ways using the North American Industrial Classification System (NAICS). These include:

- Agricultural feedstocks and industrial biosciences

- Medical devices and equipment

- Drugs and pharmaceuticals

- Research, testing and medical laboratories, and

- Bioscience-related distribution.

Each segment is further decomposed into occupations, using Standard Occupational Classification (SOC) codes. The analysis proceeds to address various topics about this collection of occupations, including:

- The extent to which various employment categories are concentrated regionally in comparison to these categories’ national representation

- The educational levels, skill sets, certifications, and experience sought by employers in these fields

- The compensation offered in the St. Louis marketplace

- Expected growth in new jobs by relevant SOC

- The institutions of learning and training that prepare people for employment in these fields

- The extent to which bioscience employees are employed in fields concentrated in bioscience industries (e.g., medical scientists, chemists, chemical technicians, chemical equipment operators) or in fields spanning many industries but which are also needed in bioscience (database administrators, cybersecurity staff, packaging & filling machine operators, computer user support specialists).

Early Indicators

At first blush, all of this would seem to be a good news story. Bioscience provides the area with many well-paying jobs for both the college educated as well as workers with a high school diploma coupled with technical training and on-the-job experience.

Especially note the Labor Market Analysis’ emphasis on manufacturing as a factor making the St. Louis region unique. This is can indeed be a source of competitive strength.

Locating research and development in close proximity to production and manufacturing can build an ecosystem effect in which R&D becomes more market- and production-focused. As a result, ideation can be more focused and the product development lifecycle shortened.

So that’s the good news. The bad news, is that “happy outcomes are not guaranteed.” Something we’ll cover in our next article.