Rise of the Rest at TechCrunch Disrupt: Heartland Tech Companies Represent A Great Investment Opportunity

Rise of the Rest at TechCrunch Disrupt SF 2018.

At last week’s TechCrunch Disrupt conference in San Francisco, Steve Case, former co-founder of AOL and current partner at VC Firm, Revolution, took to the main stage to discuss why he’s created a new fund dedicated to entrepreneurs in the Heartland.

In an illuminating and inspiring panel discussion Case and best-selling author, J.D. Vance, elucidated on the their quest to find and fund startups throughout the United States and explained why the pair are bullish on startups operating outside of Silicon Valley.

Revolution raised the $150 million Rise of the Rest (ROTR) Seed fund last year, with the backing of high profile names, almost synonymous with Silicon Valley. Founders and investors such as, Reid Hoffman, the co-founder and executive chairman of LinkedIn, Eric Schmidt, formerly the Executive Chairman of Google, and also Jeff Bezos, founder, chairman, and CEO of Amazon.

Venture Capital is Too Concentrated on the Coasts

So far, the fund has visited 38 cities and has more Rise Of The Rest Summits planned in future.

“We’ve been all over the country just trying to understand what’s happening in these cities,” Case explained to the audience, “we’re finding remarkable entrepreneurs that are building remarkable companies.”

But Case laments that venture capital is really focused on the coasts. The investment patterns is fundamentally unbalanced.

“Last year, 75% of venture capital in this country went to three states, California, New York, Massachusetts, and the other 47 states got to fight over the other 25%. We’re kind of trying to level the playing field. So everybody, everywhere, if they have an idea… they have a shot at The American Dream.”

Case Strong On Investing in the Midwest

Steve Case urged venture capitalists in Silicon Valley to give up on a ‘not in my backyard’ type attitude and get on planes to visit entrepreneurs across the nation. Expanding on his strong belief that domain expertise and partnerships are critical to the Third Wave tech economy, he argued that it makes sense to invest in the Midwest.

“75% of Fortune 500 companies are in the middle of country. And most of the leaders, in most of the sectors, are in the middle of country. So, if you believe in domain expertise, and you believe in partnerships, that should advantage these rising cities.”

Investment Arbitrage Opportunity

On investing outside of the coasts, Case foresees a huge opportunity: “We think this is one of the great investment arbitrage opportunities of, certainly, my lifetime.”

Due to the fact that as there is so little capital extended to these non-coastal regions heartland tech companies naturally tend to be undervalued, but this should be treated as an advantage.

“It’s kind of like you’re buying wholesale,” — Case emphasizes the advantage of investors getting in early — “Scott Dorsey, the entrepreneur starting that company (when it was) much harder to raise capital. And those early investors got in at a much lower valuation. So, it really is about kind of leveling the playing field.”

Moreover, strong valuations still hold when it comes to finally selling the company, “Marc Benioff didn’t say [of the Exact Target acquisition], oh, it’s an Indianapolis, we should only pay $2 billion there were $3 billion.”

Financing a Bridge. Raising the Round.

Although, Rise of the Rest functions as a normal venture capital fund, it is unusual for having an idealistic regional development cause at the heart of their approach.

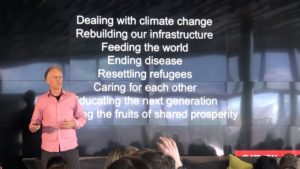

The fund’s investment thesis accounts for population and demographic shifts, while predicting the next big tech challenges: “Creativity is everywhere. Opportunity is not. So how do you bridge that, so that opportunity really is everywhere?”

Luckily, their mission driven pitch seems to resonate with investors as the $150 million fund raised exceeded initial expectations, Case elaborated.

“We thought we’re going to raise a smaller fund, and it ended up being a larger fund – and we raised it more quickly – because people really resonated with it. They did feel like something was bubbling out there that created both an opportunity and, I think, a little bit of an imperative.”

Getting Institutional Investors Off the Sidelines

On the broader goals of the investment strategy, Vance, Managing Partner of Rise of the Rest, shed more light on investor relations.

“It’s great to put your money to work at something you care about Steve and I obviously care about this a great deal… And we believe by being successful in this thesis, or cause institutional investors to get off the sidelines, for the cost of these endowments, and local pension funds to get off the sidelines. That’s the long term goal.”