Partnership for Economic Impact: Financial Empowerment and Sustainability

Improving access to financial services and critical employment skills training for low-to-moderate income communities.

Writing by Kalin Pearce. Kalin Pearce is passionate about creative collaboration, community health, and economic empowerment. With 10 years of work experience in finance and playing in bands, she’s bringing her analytical and creative tool kits to community development. She works freelance as an academic and educational writer and holds an MBA & MPH from Washington University in St. Louis.

Community Development Financial Institutions (CDFIs), workforce development and entrepreneurial support programs, as well as distribution and marketing models are all examples of how social enterprises work in tandem – symbiotically – with for-profit and political entities to accomplish a common goal.

CDFIs are loan funds, banks, credit unions, and venture capital funds that have committed to serving as mission driven organizations focused on serving economically underserved areas. CDFIs have a “goal of expanding economic opportunity in low-income communities by providing access to financial products for local residents and businesses” and work symbiotically with traditional banks to move capital to under resourced populations and development projects.

Since they understand how to work with populations that have little experience or trust in traditional financial institutions, CDFIs offer traditionally chartered banks access to low-to-moderate income communities that are often poorly connected to the larger economy with minimal risk.

Exceptional Stewards

In St. Louis, CDFIs have proven exceptional stewards for investors money and add to the pipeline of potential clients (as the clients learn more about banking and personal finance) for banks. In addition, they help banks to meet meet compliance with regulations such as the Community Reinvestment Act (CRA).

The relationship encourages chartered banks to meet the credit and depository needs of the communities within which they operate, including low- and moderate-income neighborhoods. By loaning money to CDFIs or purchasing loan portfolios from a CDFI, banks receive regulatory credit for lending in economically distressed areas at minimal risk.

Local CDFIs like Justine Petersen and IFF serve as a key partners for realizing the needs of communities often disconnected from the larger financial market.

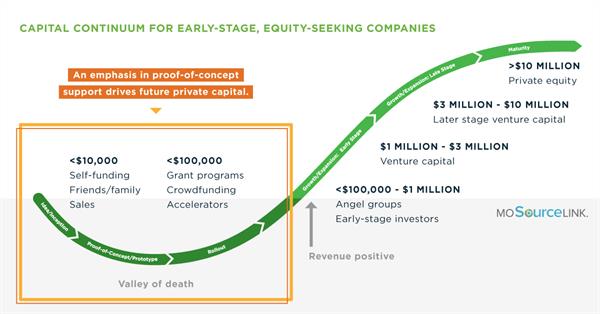

In 2018, Justine Petersen’s loan fund uses a mix of grants, CRA eligible loans, and New Market Tax Credit products for capitalization. Funds are then lent to individuals who have trouble accessing lines of credit through traditional banks which allows them to finance personal goals but also start businesses.

IFF has worked with many local and national non-profit organizations to fund community development project. For example, Beyond Housing’s community-driven initiative to build a Save-A-Lot grocery store in a food desert, was made possible through the IFF lending $1.2 million.

IFF’s David Desai-Ramirez affirmed the positive impact of CDFIs on St Louis in a conversation for EQ, “We can’t do what we do without our local banking partners.”

Workforce Development

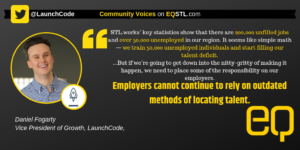

Despite having an unemployment rate roughly on par with the rest of the nation, St. Louis City has a poverty rate of 24%. There are actually more jobs open than there are people who can fill them – and this is a problem ripe for social entrepreneurs who understand how complex systems and social constructs interact, and what levers we might be able to pull to create a pathway to progress.

Clearly, there’s an opportunity for workforce development programs to connect underemployed populations to better jobs at companies of all sizes in technology, financial services, and healthcare: three areas in need of skilled labor in the St. Louis region.

Typical of the symbiotic relationship between social businesses and traditional businesses, that has seen finances improve, similar scenarios are playing out in the workforce development sector.

As traditional businesses are increasing their social awareness and becoming motivated to diversify their workforce, social enterprises and government initiatives are emerging to provide a pipeline to achieve that goal. These enterprises train historically disadvantaged populations with marketable skills and support them in accessing career positions through corporate partnerships.

LaunchCode’s apprenticeship program is extremely valuable for for-profit startups and established businesses, as it enables them to hire emerging talent for basic coding and tech needs through a relatively easy process. LaunchCode’s partnerships with employers enables them to monetize their education progrAM via apprenticeships, in order to keep expanding their facilities and abilities to continue training people.

Opportunity Hub, founded by Rodney Sampson who spearheaded the Kingonomics conferences, builds programming around “inclusive innovation, entrepreneurship and investment ecosystem building.” They partner with universities, especially historically black colleges and universities, to connect students of color with employers such as Facebook and Capital One.

Their methodology focuses on building both tech and entrepreneurship skills to ensure continued impact and success of their graduates in the workforce.

OHUB@ Campus 2018-19 by RodneySampson

Preparing for a Socially Conscious Future

The for-profit and non-profit sectors have traditionally strongly delineated themselves, but now we are seeing for-profit companies turn to the social sector for expertise. One expression of this is the emergence of more and more social entrepreneurs some even coming directly from the industries they serve.

Ben Burke formerly Director of Entrepreneurship at Arch Grants, a local seed funder for entrepreneurs that highly values the social impact of the companies it supports, told us, “We expect to see the continued increase in consumer demand for socially conscious and impactful business and funding practices.”

This article was written by Kalin Pearce with assistance and editorial by Ted Floros. The opinions expressed in this article are our own and do not necessarily reflect the views of Beyond Housing or Justine Petersen.