Presented by SixThirty

Mentorship Matters: How SixThirty Helped Fluent Disrupt the Payment Industry

For FinTech companies looking for a foothold, the right advice can change everything. SixThirty aims to mentor FinTech founders through the early stages of growth, providing guidance and facilitating access to clients through one of the world’s premier accelerator programs.

We sat down with Dave Sutter, co-founder of Fluent, a blockchain-based financial transaction network and platform, to talk about the trials of FinTech entrepreneurship and how St. Louis-based accelerator SixThirty helps young companies through them.

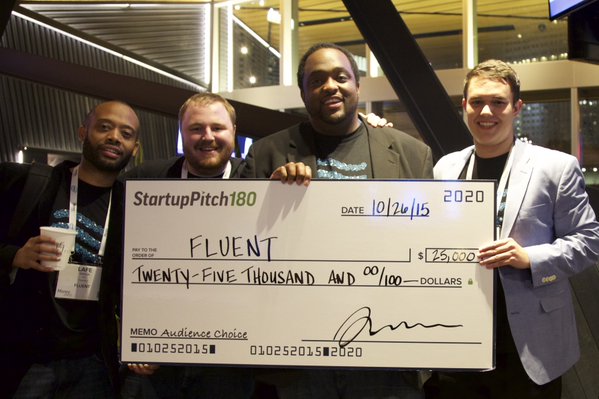

The Fluent co-founder team at Money 2020 this past October. Fluent won the $25,000 Audience Choice in the pitch contest against 14 other FinTech startups in front of 10,000 people. Dave is second from the left, surrounded by Fluent’s Kentucky-based co-founders Lafe Taylor (left) and Lamar Wilson (right), and Casey Lawlor, the other St. Louis based co-founder on the far right.

Where was Fluent before you applied to SixThirty?

When we entered SixThirty’s Fall 2015 class, we were on the cusp of our product release. We raised about three quarters of a million dollars, we had grown the team from four to 10 and we had just released our beta.

Why did you choose to apply to SixThirty?

We applied to SixThirty for a few reasons. First and foremost, the quality of mentorship that you get is really unparalleled. It’s something that’s really special to the program. You have mentors that you get to meet with multiple times a week who are very, very successful business people. They are extremely well-connected; not just in St. Louis, but nationally in financial services and business at large.

Having an opportunity to be in the room with them and have them not only offer you advice, but go to sales meetings with you, be on calls with you and make calls on your behalf is something that’s really special. It’s something a lot of startups out there would really kill for because, as a startup, you have to build your network and build legitimacy in a vacuum.

How has SixThirty helped you with customer relationships?

Companies go to the coast to raise money, but they come to St. Louis to find customers.

Coming to SixThirty, there’s a very big emphasis on revenue. Getting your product ready for market, getting your pricing on point, getting your messaging down and getting your sales processes down.

There’s a lot of weekly programming where they bring in not just mentors, but people who are really experienced to teach you how to do it. You literally put together a list of potential customers you want to talk to and not only do they connect you to them, most of the time they’ll get on the call with you or go to the meeting with you.

When you go to a meeting as a startup and you don’t have much of a track record, the first thing people ask is, “How can I trust you? How can I trust your product works and your team knows its stuff?” Having those people vouch for you and go to meetings with you–it just breaks down barriers.

What accelerators have you participated in and how has the SixThirty experience been different?

We were a part of Boost VC in San Mateo, which is blockchain specific, and Capital Innovators.

It really comes down to where a company is in its life. SixThirty is unique in that it really is focused on the financial world.

Anyone that’s been in FinTech understands that the sales cycle is very unique and probably more challenging than almost any other sales cycle, because you’re creating products that deal with other people’s money. When you’re selling a product that deals with people’s or an institution’s money, a lot of trust needs to be built.

That’s exactly what SixThirty does. It’s a stamp of approval because institutions know SixThirty is highly regarded.

What do you see as the future of transactions in the next five years and how does Fluent fit into that?

Electronic transactions come down to moving bytes of data across networks. In 2015 there’s no reason it should cost so much money and take so much time to do that [Blockchain technology is being called] the internet of finance.

What we do harnesses that technology to drive a paradigm shift of how we move money. The financial services sector is in need of a major overhaul. We think that in 2015, people shouldn’t be sending paper checks.

What is Fluent focused on now?

We are now moving into the pilot stage. We are beginning our first banking pilot (the partner remains anonymous due to an NDA) after the first of the year.

What makes building Fluent in St. Louis so attractive?

St. Louis has 19 Fortune 1000 companies and one of the highest concentrations of financial services companies in the country and they are walking distance from our office.

St. Louis needs to understand what they have here in this tech community, and specifically, the financial tech community is something really special. No one here should take that for granted. These types of programs are very unique in the United States and very unique in the world.

We’ve grown our network tremendously. The mentors that we have, the friends that we have supporting our team on a day-to-day basis making connections for us, making calls for us, going to meetings with us; we’ll have those for life.