Funding for API Innovation Center Reaches $20M, Opens Lab on UMSL Campus

Last year, EQ introduced readers to the API Innovation Center, located in St. Louis’ Cortex Innovation District. In this short article, Mike Fabrizi reports on continued progress, including a major funding infusion, the opening of a state-of-the-art lab on the University of Missouri at St. Louis (UMSL) campus, and the API Innovation Center’s awarding a contract to a local biosciences firm for the manufacture of key medicines for which there are presently limited or no domestic sources.

Writing by Mike Fabrizi. Mike Fabrizi was born and raised in St. Louis, Missouri. An expat for 30 years to the Washington, DC area, he recently retired from a career including long stints with The MITRE Corporation, of McLean, Virginia, and The Aerospace Corporation, of El Segundo, California. Mike’s professional interests include complexity and complex adaptive systems, economic complexity, cities, and regenerative agriculture. He looks for ways to bridge the urban-rural divide, and likes to emphasize that which we share in common, not that which divides us. *Most* people everywhere are good. Give them half a chance and the goodness manifests itself. Mike now happily resides back home in St. Louis.

In January 2025, the API Innovation Center received an infusion of $9.55 million from the Missouri Department of Economic Development and UMSL. This funding is to be used, in large part, to advance critical work at the new, UMSL-housed API Research and Development Lab. The work will solidify the St. Louis Metropolitan Statistical Area (MSA) and Missouri as a national hub for API and generic drug development and production.

For comparison, the API Innovation Center’s initial funding, received in March 2023, was $9.45 million (initial funder was the Missouri Technology Corporation). Hence, the Center has more than doubled its resources. Other funding has been provided by the US Department of Health and Human Services Administration’s Office for Strategic Preparedness and Response.

All this represents continued good work for Missouri, St. Louis, and the national health security. In the words of Kevin Webb, the API Innovation Center’s Chief Operating Officer (COO), “these ongoing achievements would not be possible without assistance from the State of Missouri, which recognizes the transformative work being done here.”

Why Here? Why Now?

The API Innovation Center has received wide bipartisan support in the Missouri General Assembly, as well as from the Governor. It is chartered as a 501(c)(3) nonprofit public benefit organization.

- Over 90 percent of all prescribed medications in the United States are for generic drugs.

- Due to generic drugs’ extreme price sensitivity, over 83 percent have been offshored, primarily to India and China. These countries enjoy lower labor costs. In addition, their governments provide subsidies and impose a much less stringent regulatory environment.

- This massive offshoring presents a health security risk to Americans, especially during contingencies such as a future pandemic or as a result of rising geopolitical rivalry and tensions.

- The API Innovation Center is part of a national effort to reshore these generic drugs and their Active Pharmaceutical Ingredients (APIs); six drugs (molecules) have been selected as the initial reshoring target.

- In addition to buttressing the national health security, reshoring generics would carry significant economic benefits. If the plan to reshore 25 drugs is successful, the impact to Missouri’s economy will be about $1.2 billion. Longer term, reshoring 350 medicines would generate about $17.85 billion in new economic activity across the country. This activity would include the hundreds of new high-tech, manufacturing jobs.

API Innovation Center Awards a Contract

As reported elsewhere in December 2024, the API Innovation Center selected Sentio Biosciences to develop and produce pharmaceutical molecules used for propofol (a general anesthetic) and bupivacaine (a local anesthetic). Both drugs have historically been in short supply; bupivacaine presently has no domestic ingredient source.

Tony Sardella, the API Innovation Center’s founder and chair, noted that “through collaborations like this, we are establishing resilient supply chains that reduce reliance on foreign manufacturers and utilize our Missouri-based manufacturing hub.” Collaborators in this effort include UMSL, which brought strengths in chemistry and process development, and BJC HealthCare, which was influential in the decision to target the two anesthetics for domestic production.

The API Research and Development Lab in a Strategic Context

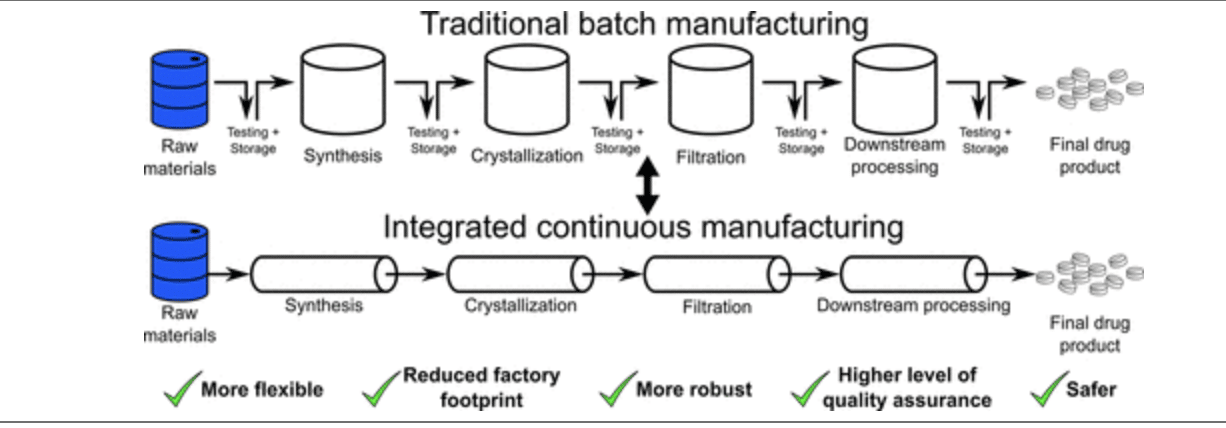

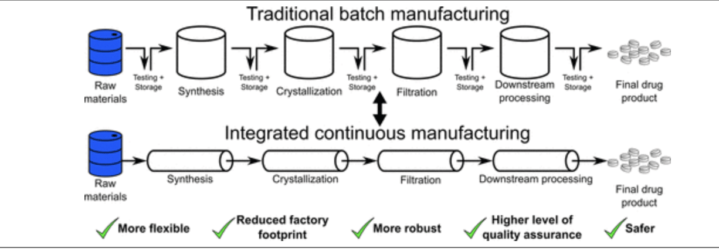

A portion of APIIC’s initial funds from the state have been spent on a new drug research and development lab, which opened on February 24th of this year, builds on UMSL’s strengths in organic and inorganic chemistry, biochemistry, materials science, and drug discovery and development. Its focus is to help transition generic drugs and APIs to continuous flow manufacturing, an approach which has numerous advantages over traditional, batch manufacturing.

Our first article provided a short and AI-assisted overview of this topic. In a nutshell, continuous flow is much more efficient and better at producing consistent quality; however, it requires expensive equipment and a different skill set.

Another advantage of continuous flow is that it can quickly change the mix of drugs produced in response to changing medicinal needs. An overview diagram comparing these two approaches is provided below.

There is more — Something really cool to which I was alerted in my discussion with Kevin Webb is that transitioning a drug from traditional, batch manufacturing to continuous flow is not as simple as taking an existing drug and churning it out on new machines.

The drug “recipes” suitable for batch are generally unsuitable for continuous flow. Hence, an essentially new drug must be discovered, formulated, and then produced using this new process.

This is where the new API Research and Development Lab will be brought to bear. Drugs intended to be reshored and made competitive with overseas production (more on that later) will need to be reformulated for the new production process.

So, why not have the pharmaceutical manufacturers pay for their own reformulation for continuous flow?

Recall, from our previous article, that the margins and return on capital of generic drug manufacturers are razor thin, which was brought about by the cost-driven “race to the bottom.”

These firms often cannot afford to take the risk that an R&D path might prove to be a dead end. Hence, a role for the API Research and Development Lab and the API Innovation Center is to “de-risk” this aspect of reshoring. After R&D solves the “drug formula/process fit”, the knowledge so gained can be transferred to commercial industry.

Before we leave the production topic, we should note that foreign generic manufacturers also use continuous flow. Discussions with Kevin Webb indicate that India is about five years ahead of us with the technology, while China’s lead is closer to a full decade.

So, if the foreign producers have at least as good technology plus less expensive inputs, how can domestic manufacturers hope to succeed?

The key here is that domestic suppliers can assure consistent quality and – perhaps even more importantly – a consistent supply of generics. Foreign supplies might be disrupted in a future pandemic, with countries barring the export of critical medicines needed by their own people. More prosaically, a foreign firm could be acquired by a multinational with a different strategic focus and subsequently lose its interest in generic pharmaceutical manufacturing. Finally, geopolitical conflicts and rising tensions could see some governments use vitally-needed medicines as a means by which to engage in arm twisting.

A supply disruption would force domestic pharmaceutical procurers – hospitals, pharmacies, Government health-care providers, and others – to scramble for alternative vendors, likely precipitating a price shock. Worse, some Americans might be unable to get needed medicines at a price they could afford, or at any price. Hence, assuring a consistent, reliable and high- quality supply would likely persuade the procurers to accept a small price premium, which is all domestic producers would need to regain market share.

Once this foothold is achieved, scale production and the ability to quickly adjust to changing medicinal needs would further erode foreign manufacturers’ advantages.