Presented by Cultivation Capital

12 Fundraising Tips for BioTech Companies from Cultivation Capital’s Life Sciences Fund

Bill Schmidt, Managing Partner of Cultivation Capital's Life Science Fund, shares tips for BioTech companies focused on fundraising.

Bill Schmidt, Managing Partner of Cultivation Capital’s Life Science Fund, is optimistic about the future of Life Science investment in St. Louis.

He said, “more capital is flowing in St. Louis, with us, BioGenerator, RiverVest Venture Partners, Lewis & Clark Ventures, Ascension Ventures, iSelect Fund, St. Louis Arch Angels, Missouri Technology Corporation, and others. And, we are starting to get attention from upmarket VC firms on the coasts, which is great, as our companies are going to need it.”

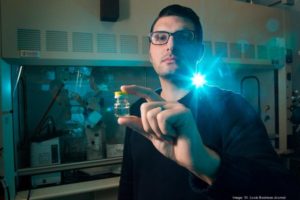

Cultivation Capital’s Life Sciences fund invests in early-stage companies, primarily in the therapeutics, diagnostics, research tools and reagents, medical devices, and healthcare information technology verticals. Schmidt’s basic advice for BioTech companies seeking the next level of funding is to have a great idea that meets an unmet need, which creates value.

He suggests that companies need to be able to answer the question, “how did you use your prior funding and what milestones did you achieve with it?” In other words, past behavior dictates future behavior, and if a company has demonstrated the ability to build value in the past, its next capital raise will be much easier.

Here are more tips from Schmidt for life sciences companies going into fundraising:

1. Start with a great team and hire great people.

As the adage goes, investors will take an “A” team with a “B” idea over a “B” team with an “A” idea every time! Life Sciences Fund recipient Euclises, a drug discovery and development company, was built around Chief Scientific Officer John Tally, PhD, arguably one of the world’s top medicinal chemists.

2. Don’t plan to exit from the start.

Run it as though it will be a stand-alone, sustainable business. Don’t run it with the mentality of simply taking it to an exit.

Do this and your exit will come. For Cardialen, a company that offers a unique atrial fibrillation (AF) treatment released from an implantable device, Cultivation Capital plans to raise the appropriate amount of capital to take the device all the way to CE Mark (a manufacturer’s declaration that the product meets standards for use in Europe).

It sends a message to strategic buyers that we are prepared to go it alone.

3. Don’t give up.

Raising capital is hard. Markets are honest and truthful.

Something needs to change with your strategy if you are unsuccessful. Go after non-dilutive grant funding whenever possible.

Sean Morris, CEO of Pulse Therapeutics, for example, was relentless in finding a Series B lead investor. The company has also raised significant grant funding, which allowed Dr. Igor Efimov, Founder and Chief Scientific Advisor, to conduct tremendous research.

4. Take “smart” money.

Smart money from those that have useful advice, expertise and contacts is hands-on and involved. Take smart money even if it’s under inferior financial terms (within reason, of course). Adarza did this working with my colleague, Life Sciences Fund General Partner, David Smoller, among others.

5. Be capital efficient.

Be prepared to give key hires equity in lieu of market rates for annual compensation.

Note that in the event of voluntary resignation, penalties should be harsh – up to and including total loss of equity ownership in the early years. Most of our portfolio companies adhere to this approach to conserve cash.

6. Socialize the idea early and often.

Keep people apprised of your progress, including when you are not raising capital. I really like Medical Holography Solutions.

While it’s too early for them to receive funding from Cultivation Capital, they are great about keeping me up to speed on their progress.

7. Network like crazy.

Take in a few key pearls of information from every conversation and elicit feedback from others… it’s the breakfast of champions!

Blake Marggraff, CEO of Epharmix, has immediately engaged with everyone I’ve introduced him to, and it’s paying dividends.

8. Hit milestones on time.

Very few young companies do this and it can set you apart. Hold everyone accountable for everything.

BlueStrata CEO Tony Coco put a plan in place and they are executing against it. He is always extremely prepared and provides great leadership. Arvegenix CEO Jerry Steiner is one of the most planned and prepared people I’ve ever met.

9. Embrace change in the vision as necessary.

Adapt and pivot, including with staff. Transition from researchers or developers to operators to commercially focused teams as your company grows up. Cardialen is now adding VF (ventricular fibrillation) and VT (Pulseless Ventricular Tachycardia) to their great work in AF (atrial fibrillation).

10. Understand the audience.

It may even be the FDA early on (and no one else). Both Pulse Therapeutics and Euclises engaged the FDA early to identify gaps in their clinical strategy.

11. Produce early data.

Promising animal studies are great, but will they be translational to humans? For Euclises, Galera Therapeutics, Tioma Therapeutics, Pulse Therapeutics, Cardialen and others, the key was in the early data.

12. Show your growth.

For Healthcare IT, you must have pilot tested your software and converted your pilots to revenue-generating clients.

Demonstrating month-over-month growth is critical for engaging a VC. Blue Strata demonstrated this, and it stood out to our investment committee.