Presented by for Trackbill

2015 St. Louis Capital Report: Brian Matthews Outlines Funding From Angels and Venture Capitalists

From a number of perspectives, 2015 was the best fundraising year for the St. Louis region since 2004.

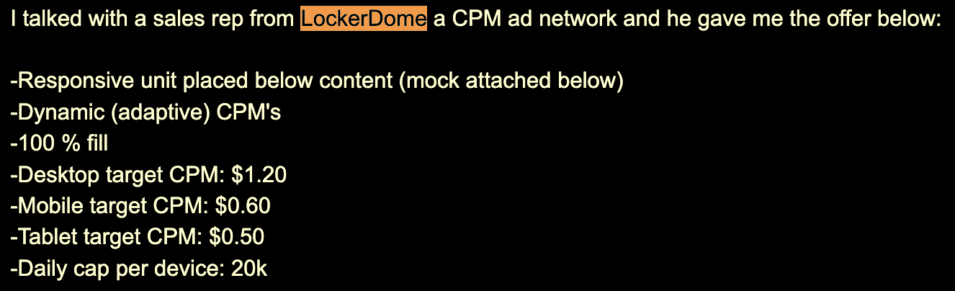

Writing by Brian Matthews. Brian Matthews co-founded Cultivation Capital. Brian has a passion for mentoring and developing start-up founders. He is an investor and mentor at Capital Innovators and a founder of River City Internet Group. Brian is a serial entrepreneur having co-founded and assisted in the sale of the following technology companies: Primary Network to Mpower Communications in 2000, Primary Webworks to Perficient in 2001, CDM Fantasy Sports to Liberty Media in 2006, and IntraISP to Clearwire Communications in 2007. In addition to his role at Cultivation Capital, Brian serves on the boards of LockerDome, Hatchbuck, TopOPPS, Tunespeak, Aisle411, Globalhack, and the Friends of T-REX. Brian is also a General Partner in the SixThirty FinTech Accelerator. Brian has a B.S. in Mechanical Engineering from the Missouri University of Science and Technology and worked at McDonnell Douglas for 12 years before beginning his entrepreneurial career in 1993.

From a number of perspectives, 2015 was the best fundraising year for the St. Louis region since 2004. Notable numbers include:

- $258 million raised by 91 companies

- At least $1 million raised by 34 companies

- $50 million was raised by Varsity Tutors

- $80 million raised by Rivervest Fund II

- $70 million “A” raised by Lewis & Clark

- $40 million late seed raised by Cultivation Capital Tech Fund II

All the numbers quoted in this article are from Crunchbase. Crunchbase is an open-sourced venture and private equity transaction database.

Others have used CB Insights (A fee-based venture and private equity investment tracking database) to report annual investment results. Neither of these data sets are 100% accurate; we also supplemented the data with deals that Cultivation Capital closed during 2013-2015 that were not fully reported in Crunchbase. We also should note that Crunchbase’s data depends on startups that register on its database.

Year Over Year Comparisons & Growth

The 2015 total of $258 million in invested capital by angels and venture capitalists in the St. Louis region is the largest amount since 2004.

There were 91 total investments for an average of $2,835,000 per investment. This average compares in line with both the 2013 and 2014 numbers of $2,432,000 and $2,830,000 respectively.

There were 34 companies that received at least $1 million in 2015, which exceeds both 2013 (33 companies) and 2014 (24 companies) results.

2015 Notable Investments

The largest venture investment in 2015 was $50,000,000 in Varsity Tutors. This is actually the largest venture round (non-private equity and non-venture debt) since 2004. Other notable St. Louis investments in 2015 include:

- $41,720,000 in Veran Medical (Venture)

- $40,000,000 in Gateway Media (Venture Debt)

- $27,458,000 in Medibeacon (Venture & Venture Debt)

- $10,200,000 in Appistry (Venture Debt)

- $7,300,000 in Advance ICU (Venture)

- $5,000,000 in EternoGen (Venture)

- $3,600,000 in TopOpps (Venture)

Software Vs BioTech/Healthcare

Of the $258 million raised by St. Louis companies, $150 million was raised by software technology companies and $108 million was raised by healthcare and biotech companies. The 64 software technology companies averaged $2,342,000 per investment and 27 healthcare and biotech companies averaged $4,0038,000 per investment. We did not break out previous years to see how this compares but plan to do so in future years.

2013 Data

It had been reported in 2013 that St. Louis experienced an investment total of $380 million, however, that included a private equity investment in Answers. These previously reported numbers used a private equity investment of $200 million, but Crunchbase reports that it was actually $300 million of private equity investment.

For this article, I have removed that investment as we are not tracking private equity numbers. This reduces the 2013 total to $180 million. The largest venture investment in St. Louis for 2013 is $9,133,000 in Endostem.

2013 finished with 75 companies raising money at an average of $2,432,000 per deal. There were 33 companies that raised at least $1,000,000 in 2013.

2014 Data

The 2014 numbers from Cruchbase show a total of $169 million vs. a reported total of $222 million by CB Insights in 2014.

It is my guess that the CB Insights either included private equity amounts or possibly non-venture debt in their numbers. The other possibility is they included a company such as Gainsight or Splice Machine who have presence in St. Louis but whose headquarters is now in the Bay area.

Notable venture investments in 2014 include:

- $39,000,000 in Answers (Venture)

- $18,500,000 in Veran Medical (Venture & Venture Debt)

- $17,000,000 in New Leaf Symbiotics (Venture)

- $11,000,000 in Bacterioscan (Venture)

- $10,000,000 in LockerDome (Venture)

- $8,000,000 Isto Technologies (Venture Debt)

- $7,000,000 in Adarza Biosystems (Venture)

- $7,000,000 in Varsity Tutors (Venture)

- $6,365,000 in Endostim (Venture Debt)

- $4,028,000 in Cardialen (Venture)

Looking Ahead

With the addition of three new venture funds in 2015 that raised almost $200 million, I would expect the next few years of venture invested capital to be even bigger, as many of our late seed stage and “A”-stage funds start to raise larger and later rounds of capital.

I predict that 2016 will see 75 companies, within the St. Louis region, receive over $300 million in new venture invested capital with an average raise of $4,000,000. I am also predicting 2-4 exits in 2016.